Letter To Waive Penalty Charge / Appeal Letter for Housing-01 – Best Letter Template / Letter of waiver for immigration sample.

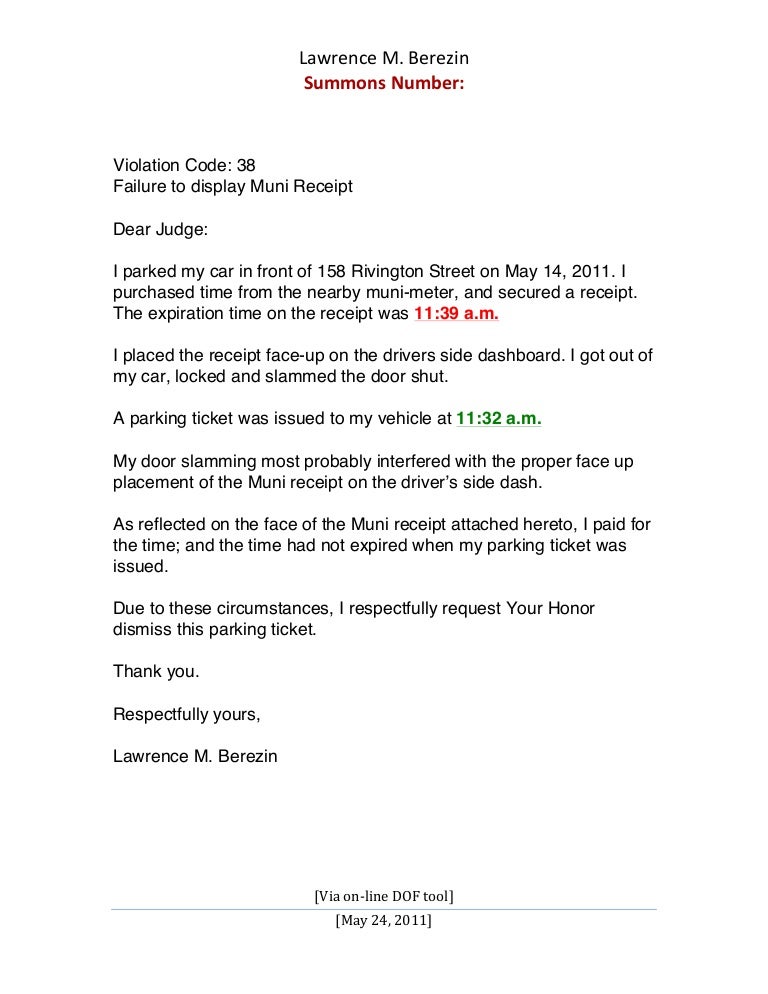

Letter To Waive Penalty Charge | A waiver of penalty letter is a formal request in writing to waive a penalty that has been imposed on you. You have 30 days from the date of the … If you don't respond, or if you respond incorrectly, the irs will charge you the tax it thinks you owe, plus interest and possibly a penalty. 25.02.2021 · if the irs rejected your request to remove a penalty, you may be able to request an appeals conference or hearing. If you feel that such is undeserved, or if you feel that it would unfairly affect you, then you can ask for it to be waived. For instance, you may be given a citation, a penalty fee, or a new financial obligation. Dear sir or madam, i am writing this letter respectfully requesting that you waiver my visa penalty due to past criminal record and reconsider my application. I am requesting that you waive the penalty fee and interest assessed on the above referenced account for the month of.,2013.the payment here was sent only one day late because of end of the year mailing issues.the payment was received only one day late and i am asking that you waive this here as a one time, one day late. Photographic evidence, insurance claims or news articles for disasters. Facts in your irs penalty abatement letter to back up the circumstances that you write about in your letter. You may qualify for relief from penalties if you made an effort to comply with the requirements of the law, but, due to circumstances beyond your control, were unable to meet your tax obligations. 28.12.2010 · but a few still charge a membership fee annually. Administrative waiver and first time penalty abatement; Letter of waiver for immigration sample. Some types of penalties are eligible for penalty relief, including the penalties for failure to file or pay on time, or for the failure to deposit certain business taxes as required. 25.02.2021 · if the irs rejected your request to remove a penalty, you may be able to request an appeals conference or hearing. That said, there is no guarantee that the issuing agency will give in to. Photographic evidence, insurance claims or news articles for disasters. If you feel that such is undeserved, or if you feel that it would unfairly affect you, then you can ask for it to be waived. For instance, you may be given a citation, a penalty fee, or a new financial obligation. You have 30 days from the date of the … At this point, i can hardly afford to keep food on the table for my children. These records will prove that you were indeed incapacitated or too ill at the time to file/pay your taxes. I fully understand that the united states cannot accept anybody that would pose a safety threat to citizens or economic burden due to. For instance, you may be given a citation, a penalty fee, or a new financial obligation. Some prefer credit card holders to request a fee waiver via a phone call, but most require a request letter from your registered email id. You may qualify for relief from penalties if you made an effort to comply with the requirements of the law, but, due to circumstances beyond your control, were unable to meet your tax obligations. At this point, i can hardly afford to keep food on the table for my children. 09.12.2021 · the following types of penalty relief are offered by the irs: Some prefer credit card holders to request a fee waiver via a phone call, but most require a request letter from your registered email id. 15.01.2019 · waiver request letter samples. Some types of penalties are eligible for penalty relief, including the penalties for failure to file or pay on time, or for the failure to deposit certain business taxes as required. Letter of waiver for immigration sample. Here's exactly how to handle a cp2000 notice. These records will prove that you were indeed incapacitated or too ill at the time to file/pay your taxes. That said, there is no guarantee that the issuing agency will give in to. A waiver of penalty letter is a formal request in writing to waive a penalty that has been imposed on you. You have 30 days from the date of the … This remains true for late fees, as well. Most of these credit card companies, though, will waive the fee if you know how to request a fee waiver, and through which medium to do so. 25.02.2021 · if the irs rejected your request to remove a penalty, you may be able to request an appeals conference or hearing. I fully understand that the united states cannot accept anybody that would pose a safety threat to citizens or economic burden due to. 17.05.2021 · letter to waive penalty charge / sample letter waive penalty fees : 15.01.2019 · waiver request letter samples. For instance, you may be given a citation, a penalty fee, or a new financial obligation. Here's exactly how to handle a cp2000 notice. For example, hospital records or a letter from a doctor with specific start and end dates. Facts in your irs penalty abatement letter to back up the circumstances that you write about in your letter. Administrative waiver and first time penalty abatement; This remains true for late fees, as well. If you feel that such is undeserved, or if you feel that it would unfairly affect you, then you can ask for it to be waived. 15.01.2019 · waiver request letter samples. Some prefer credit card holders to request a fee waiver via a phone call, but most require a request letter from your registered email id. Letter of waiver for immigration sample. A waiver of penalty letter is a formal request in writing to waive a penalty that has been imposed on you. Most of these credit card companies, though, will waive the fee if you know how to request a fee waiver, and through which medium to do so. I am requesting that you waive the penalty fee and interest assessed on the above referenced account for the month of.,2013.the payment here was sent only one day late because of end of the year mailing issues.the payment was received only one day late and i am asking that you waive this here as a one time, one day late. 09.12.2021 · the following types of penalty relief are offered by the irs: 17.05.2021 · letter to waive penalty charge / sample letter waive penalty fees :

Letter To Waive Penalty Charge! For instance, you may be given a citation, a penalty fee, or a new financial obligation.

0 Comment